Luminate and Nielsen Serve Up 2024 Report on Consumer Insights

A Sweet Look at Streaming Trends and Metrics from Market Research Leaders Luminate and Nielsen.

Welcome to StreamScoop, an independent media news outlet focused on consumers insights across broadcasting and streaming.

Today, we’re going to do an analysis of both Luminate and Nielsen’s end-of-the-year review.

Just a reminder on how each company measures audience engagement on streaming:

Luminate: Total minutes viewed on the TV panel from Friday to Thursday.

Nielsen: Total minutes viewed on the TV panel from Monday to Sunday

Nielsen’s 2025 review

Nielsen, the market leader in media insights, has released its year-end 2025 report alongside the annual ARTEY Awards, providing a wealth of valuable data.

The following are Nielsen’s Top-Ten rankings in each of their three measured categories; Acquired, Movies, and Originals.

Top 10 Original Streaming Programs

Netflix: Bridgerton - 21.423M

Netflix: Love is Blind - 16.448M

Prime Video: The Boys - 13.584M

Netflix: The Lincoln Lawyer - 12.435M

Prime Video: Fallout - 11.953M

Hulu: Futurama - 11.747M

Netflix: Fool Me Once - 10.887M

Netflix & Paramount+: Evil - 10.762M

Netflix & Prime Video: Gabby’s Dollhouse - 10.738M

Prime Video: Reacher - 10.568M

Top 10 Acquired Streaming Programs

Disney+: Bluey - 55.62M

Netflix & Hulu: Grey’s Anatomy - 47.846M

Hulu: Family Guy - 42.442M

Hulu: Bob’s Burgers - 36.798M

Hulu & Netflix & Paramount+: NCIS - 35.906M

Max & Netflix & Paramount+: Young Sheldon - 32.081M

Max: Big Bang Theory - 29.118M

Hulu & Peacock: Law & Order: Special Victims Unit - 28.724M

Hulu & Paramount+: Criminal Minds - 28.404M

Paramount+: Spongebob - 27.873M

Top 10 Movies Streaming

Disney+: Moana - 13.026M

Netflix: Super Mario Bros. Movie - 11.719M

Prime Video: Red One - 8.276M

Netflix & Peacock & Prime Video: Trolls: Band Together - 7.437M

Netflix: Minions - 6.773M

Disney+: Encanto - 6.614M

Disney+: Frozen - 6.283M

Paramount+: Paw Patrol: The Movie - 6.049M

Disney+: Inside Out - 5.775M

Netflix: Boss Baby - 5.692M

Nielsen’s ARTEY Awards:

Most-Binged Show

Runner-up: American Dad!, 175.3 episodes per viewer on Hulu

Also mentioned: “Family Guy, Bob’s Burgers, The Simpsons and South Park all finishing in the top 30 for total minutes in 2024.”

Legacy Award

Runner-up: Gunsmoke, 10.23 billion minutes on Peacock / Paramount+

My Scoop:

It’s pretty clear that one type of content is superior on streaming: children’s content.

Child content is a huge audience driver across the streaming landscape, where adolescents are able to watch a variety of series, movies and original content.

The number one watched program across all of streaming was Bluey available on Disney+, with a variety of other children’s content dominating all three of Nielsen’s categories.

Every single movie in the top-ten is a kids project. Three of the top-ten acquired programs are children’s series.

Children’s content is a HUGE audience driver across streaming.

Procedural Dramas are not just for the elderly.

When we analyze a lot of this content, a lot of it can be simplified to a procedural drama, whether it be legal, medical or otherwise.

These series have a large selection of episodes to choose from, giving users decades of drama content available to consume.

Long-running adult animated projects retain their audiences.

In the text discussing the runner-up of Nielsen’s most-binged award they denote that American Dad came in second with, “Family Guy, Bob’s Burgers, The Simpsons and South Park all finishing in the top 30 for total minutes in 2024.”

These series were so innovative during their creations that they have amassed dedicated fans over the decades. Even Bob’s Burgers came at a stagnant time for adult-animated projects and it did really well by blending the edginess of adult-animation but making it a little more palatable for a wide audience.

Luminate’s 2025 review

Wow, there’s a ton of data and metrics within Luminate’s yearly report including information relating to production volume in entertainment, and streaming and film streaming trends.

Here you can access Luminate’s 2024 Year-End Film & Report.

Let’s dive in!

And I’ll go ahead and give my analysis below each data chart as it’ll be easier to read.

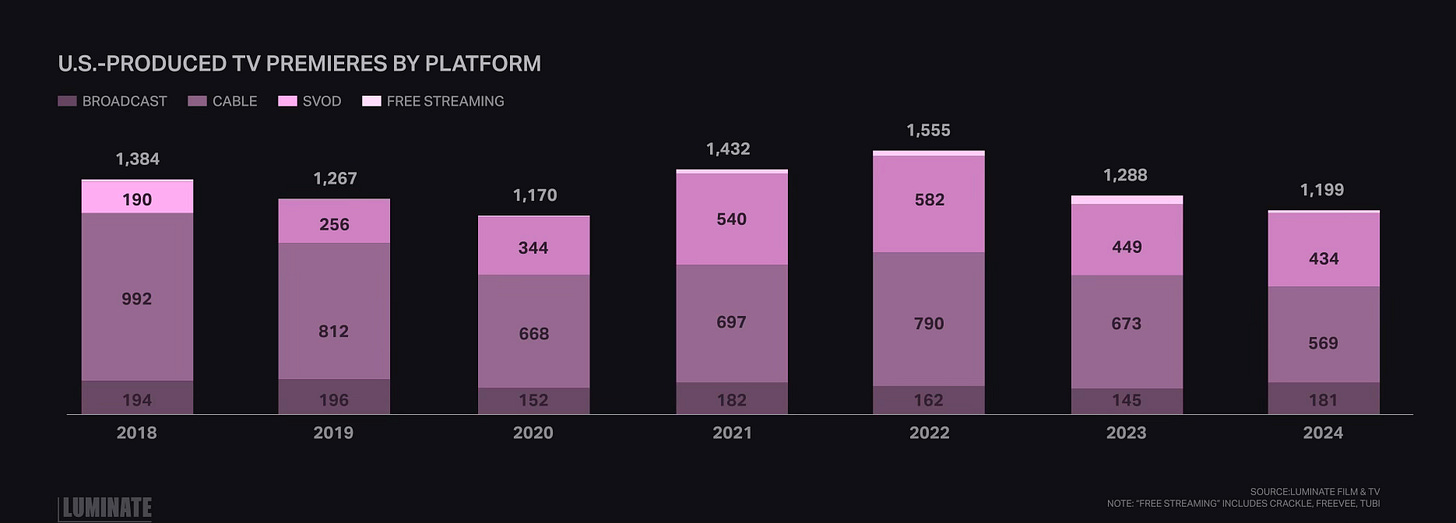

Programs produced by platform:

I wanted to highlight this graph showcasing the volume of series produced for each platform type. I’m a little shocked by the decrease in Free-Streaming content, especially in the span of the last several years their prevalence with entertainment consumers has risen, I expect a slight increase in volume next year.

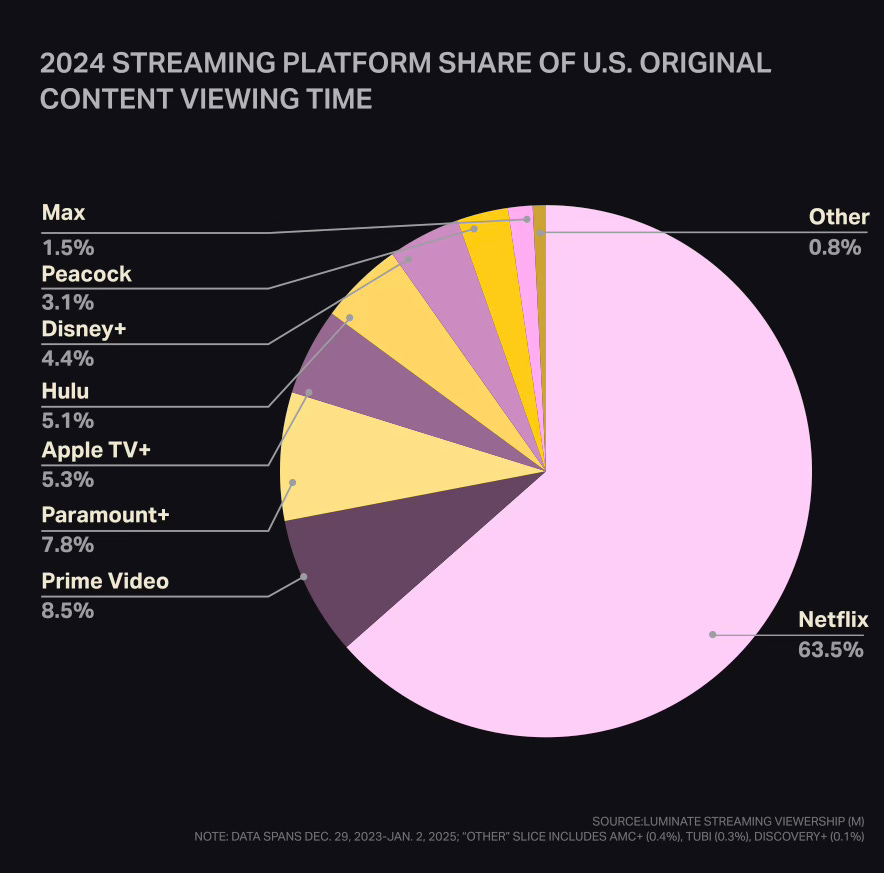

Streaming Share per Service:

What I find most interesting about this graph is the measurement that AppleTV+ is the fourth most-used streaming service among U.S. users, and Paramount+ is just ahead at number three.

When looking at Nielsen’s usage data Paramount+ consistently ranks at the very bottom among the major services, with AppleTV+ not even able to show up in the category their usage is that minuscule.

That being said, I’m not sure if their panel is 100% accurate, it’s EXTREMELY hard to believe that AppleTV+ and Paramount+’s viewing time is greater than Disney+’s.

Take this measurement with a grain of salt.

Top Programs across Broadcasting:

Just wanted to include this.

For those who need to hear this, broadcasting isn’t dead.

Top Ten Original TV Programs:

In a landscape where original content reigns supreme, it's no surprise that a staggering 70% of the top ten most-watched originals are funded by Netflix. However, the rankings might surprise some; for instance, many expected Bridgerton to take the top spot.

A standout performer in this mix is Paramount+, which has effectively released relevant originals that resonate with audiences. Taylor Sheridan continues to prove his prowess, as evidenced by the viral success of Landman, which has quickly become one of the biggest original dramas of the year. This trend mirrors the popularity of Sheridan's past works, further solidifying his reputation in the industry.

Remarkably, Landman debuted in mid-November, leaving us to wonder how much higher its viewership could have soared had it been released earlier in the year. Additionally, Paramount+ has seen strong performance from Tulsa King, Sylvester Stallone’s midwestern mob series, which has tracked exceptionally well during its second season.

Overall, while Netflix maintains its dominance, Paramount+ is clearly making strategic moves to capture the audience's attention.

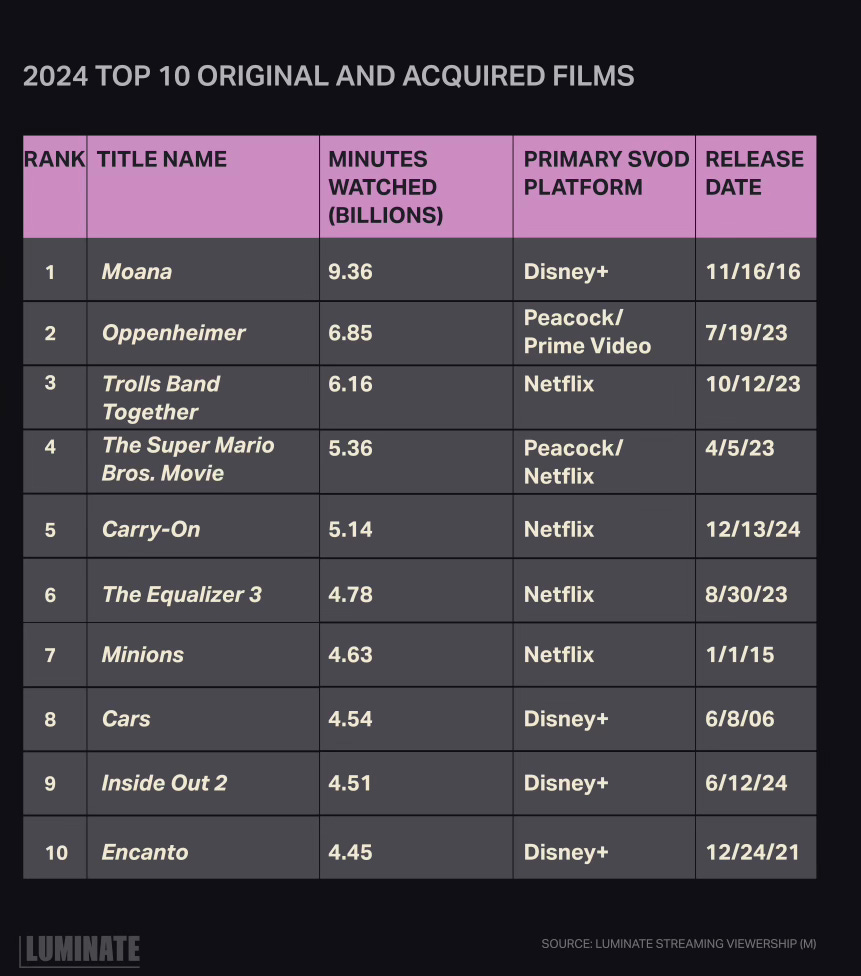

Top Ten Original & Acquired Movies:

It's worth repeating: kids' content reigns supreme in the streaming world.

The latest data highlights just how dominant children's programming is, with seven out of the top ten films being aimed at younger audiences. This includes a mix of new releases and beloved titles from the past decade.

Disney's animated films, in particular, continue to drive impressive viewership numbers. Classics like Cars, Encanto, and Moana remain consistently popular, showcasing the enduring appeal of family-friendly content. As streaming platforms prioritize engaging children's programming, it's clear that this genre will continue to capture the hearts of families everywhere.

Top Ten Original & Acquired Movies:

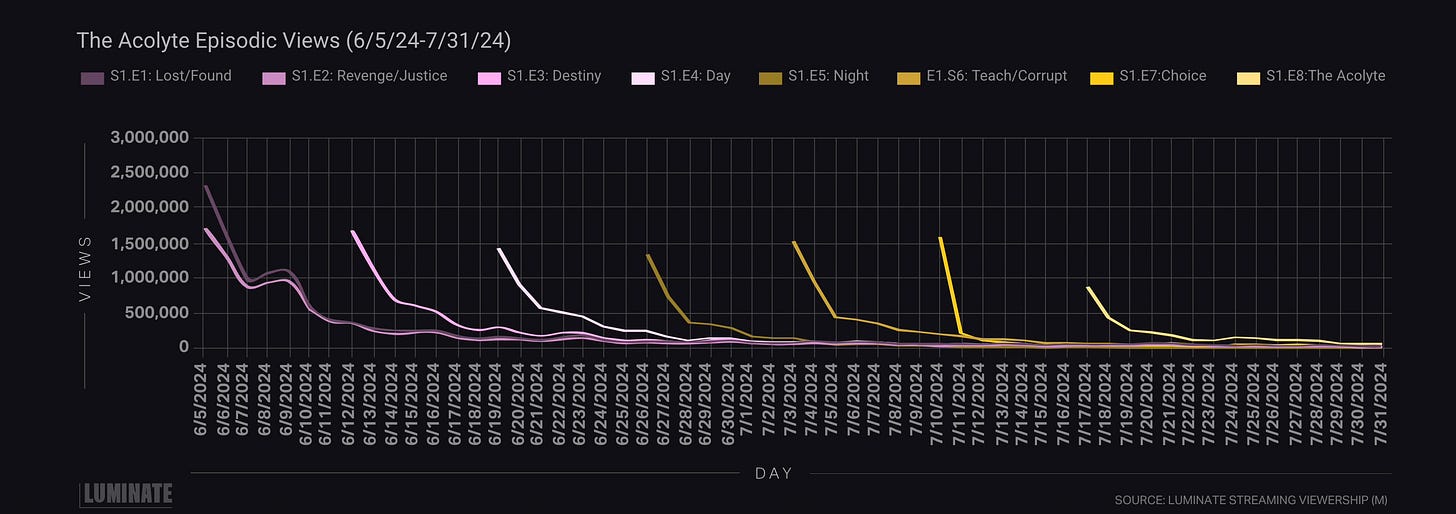

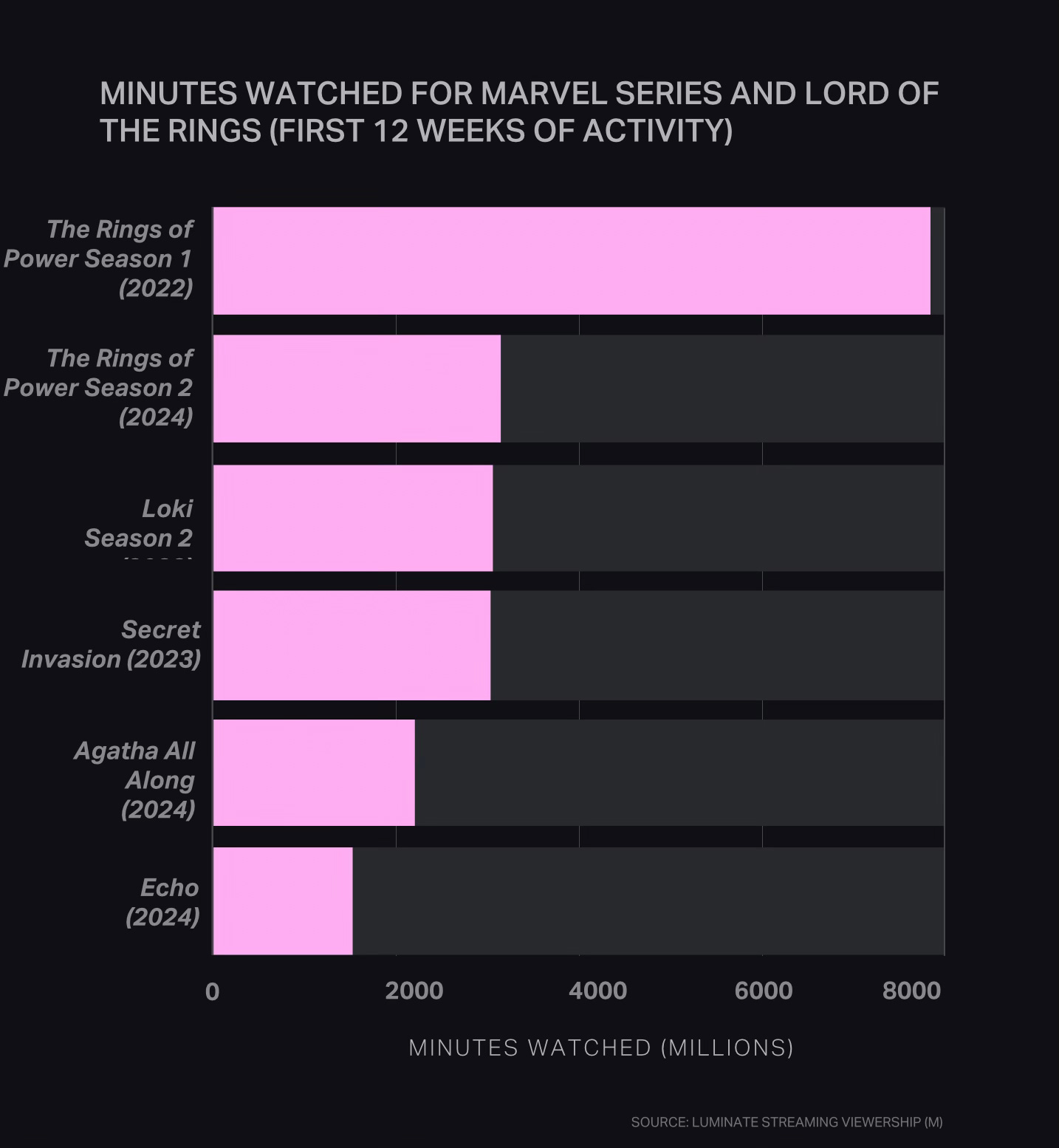

So I think that it’s pretty obvious that Disney is fumbling with leveraging their two largest IP’s- Marvel and Star Wars into large audiences for original programming.

Despite the fact that there are three 2024 Star Wars series and three 2024 Marvel shows, it’s pretty clear that they’re struggling to attract large audiences.

Percy Jackson was released in December of 2023, and was able to outperform several newly-released series connected to an infinitely more powerful properties.

The following is further research into viewership declines for The Acolyte and analyzing viewership declines for MCU series:

Thanks for reading! Make sure to tune back in for Wednesday’s weekly newsletter The Midweek Scoop, focused on media news from across the industry over the past week.